Investment Advisory Services for Strategic Growth

Discover our comprehensive wealth management solutions

REQUEST A MEETINGOPTIMIZING WEALTH MANAGEMENT FOR HNWI, FAMILY OFFICES & ENDOWMENTS

As liquid assets grow, so do the challenges of managing them effectively. We establish dedicated investment offices and endowment funds to ensure sustainability, capital growth, and governance.

A high-performing investment office goes beyond wealth management, driving asset diversification, governance, and performance monitoring. Depending on asset value, management can be insourced or outsourced.

At Hauberk Capital, we provide outsourced wealth management solutions to reduce costs, enhance governance, and optimize asset allocation—ensuring long-term financial success.

01

GOVERNANCE ADVISORY

Strengthening structures for sustainable success.

02

WEALTH PLANNING

Strategic planning to protect and grow your wealth.

03

STRATEGIC INVESTMENT ADVISORY

Data-driven insights for smarter investments.

04

CIO OFFICE SERVICES

Enhancing portfolio management efficiency.

GOVERNANCE ADVISORY

We help establish strong governance frameworks to ensure compliance, risk management, and long-term sustainability, enabling better decision-making and control over asset diversification.

STRATEGIC INVESTMENT ADVISORY

We provide data-driven investment strategies that align with your long-term goals, ensuring optimal asset allocation, risk management, and performance tracking for sustainable capital growth.

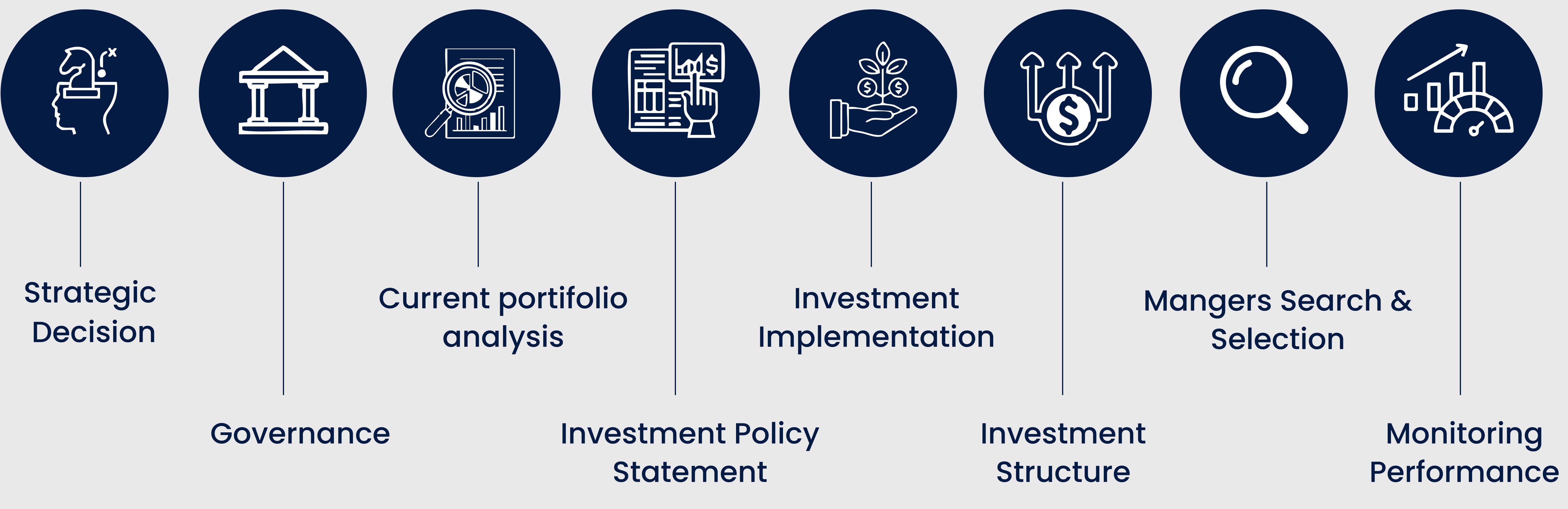

CLIENT'S ROAD MAP

Strategic Decision

Governance

Current portfolio analysis

Investment Policy Statement

Investment Implementation

Investment Structure

Managers Search & Selection

Monitoring Performance

READY TO START GROWING?!

Unlock the full potential of your wealth